article

Pre-Retirement Checklist

You have been dreaming of this moment for years. The time has come to start planning for your retirement.

“I’m retired… Now what?”

Sound familiar?

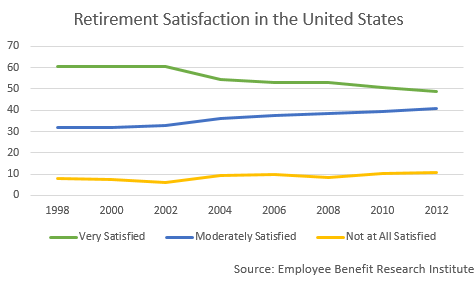

While most Americans dream of retirement, many are unprepared for the reality. According to a 15-year study by the Employee Benefit Research Institute, fewer retirees than ever describe their golden years as “very satisfying.” Even worse, the number of retirees that report being “not at all satisfied” has risen.1

Common sense would dictate that more money leads to a happier life. While this may be true for many retirees, money is not the only factor. Within the same study, both the wealthiest and poorest retirees showed decreasing levels of satisfaction.

With this in mind, retirees must create a plan for their next chapter of life—beyond finances. Below, we’ve listed a step-by-step approach to ensure you get the most out of your golden years.

Bill Copeland said “The trouble with not having a goal is that you can spend your life running up and down the field and never score.”

Mental health needs may require some leisure time, but an entire retirement dedicated to idleness will not provide fulfillment. In fact, a recent survey reported that 10 percent of retirees were surprised to find themselves bored, without a sense of purpose, and/or depressed.2

To create a meaningful life, new retirees must set strong personal goals. Strong goals will force you to establish clear values and make your life hold meaning as you live true to them.

To get started:

Take out a pen and paper and reserve 10–15 minutes to brainstorm your values. Ask yourself:

Which peak experiences made me feel completely fulfilled and within my element?

What are my three greatest accomplishments? Why?

If given the choice, what would I never do again? Why?

Once you’ve finished brainstorming, review your work and find patterns to identify your core values.

Now, think 30–40 years ahead (or more!) to your obituary. Take 10 minutes to brainstorm which statements you would like written about you. Once complete, take time to review. Which obituary statements align with your core values?

Now, set goals that will help you fulfill those values. For instance, if you want your obituary to read, “Anthony was a strong voice in the community,” which goals would carry you there?

Pursue your goals with vigor.

To stay on track, you may find it useful to create a vision board, or a visual representation of your retirement goals. Try to keep an open mind; it’s okay to reevaluate your values as you move forward in your retirement experience.

Money is not the only key to a happy retirement, but it remains essential. Unfortunately, due to rising inflation and advanced medical care, outliving one’s assets is a real possibility.

While it’s important to keep your money “safe” in bonds and CDs, be sure to consult with your financial advisor to ensure you have investments that will offset inflation and taxes.

For day-to-day spending, make sure your funds are stored in accounts with high interest yields. [Learn more about UFB Direct’s industry-leading savings accounts here.]

Like money, health is a strong indicator for a successful retirement—healthy retirees are happy retirees. With this in mind, create a plan to optimize your health.

To get started:

Schedule an initial check-up with your doctor. Continue to reschedule check-ups on an annual basis (or according to the frequency recommended by your doctor). Between appointments, be sure to call your doctor with any concerns. Do not wait until the last minute to raise any issues.

Maintain a rigorous exercise routine. According to the Center for Disease Control, older adults need at least 150 minutes of moderate-intensity aerobic activity per week, paired with muscle-strengthening activities twice per week.3 Find exercise activities you enjoy, as these will be easier to commit to.

Be mindful of what you put into your body. A study from the Journal of the American College of Cardiology reports that people who adopt a healthful, plant-based diet—while limiting animal products—have the lowest risk of heart disease.4 To optimize your health, stick to nutritious plants, limit your animal product intake, and moderate both your alcohol and caffeine consumption.

Friendships are key to an enjoyable retirement. In fact, research indicates that social relationships have a significant effect on both mental and physical health.5 Unfortunately, far too many Americans limit their social interactions to work or business relationships. Considering this, retirees must create a plan for building relationships outside of the office.

To build your social circle:

Start by finding like-minded individuals. Social websites like Meetup allow anyone to find or start a group based on a common activity, like hiking, knitting, or even “renaissance combat.“ You can narrow your search to those groups that focus on your specific age or locality.

Join local clubs or organizations. Do you have an activity or cause that you’re passionate about? Search for a local chapter that works in this field. For example, if your passion is animal welfare, you may want to volunteer at a local humane society.

Don’t forget your ready-made social circle—your family. Retirement is a great opportunity to keep in touch and visit with loved relatives. Have grandchildren, nieces, or nephews? Be sure to reserve time for them on a regular basis. Children are notorious for growing up too fast.

Think an old dog can’t learn new tricks?

Think again.

Not only can an old dog learn new skills, but young pups in the workplace can also learn from an experienced pooch.

In fact, the University of Zurich found that increased age diversity improved the performance of innovative companies.6 Lending your expertise will help to keep your mind sharp while passing valuable wisdom to the next generation of leaders.

Consider taking a part-time job as a business consultant, or perhaps joining a company’s board of directors. Or, instead of retiring fully, discuss with your supervisor the possibility of reducing your hours from full-time to part-time.

You only have one life—use your newfound time surplus to live it to the fullest.

Have you always wanted to learn computer science? Or maybe you’ve always regretted not joining the Peace Corps. Now is the time. Keep an open mind and be willing to try new activities during this next chapter of your life.

Of course, do this all within reason – you would not want to outpace your finances.

While important, money is not the only key to a happy retirement. To live a life of meaning, it’s important to maintain your health, build friendships, and sharpen your mental skills while keeping your finances intact.

To ensure this happens, create a plan and set goals. Only then will you look back on a life well-lived.

1. Banerjee, Ph.D., Sudipto, “Trends in Retirement Satisfaction in the United States: Fewer Having Great Time,” Employee Benefit Research Institute, April 2016.

2. “The hopes, fears and reality of retirement,” TwoWest Advisors, January 2015,.

3. “Physical Activity for Older Adults,” Centers for Disease Control and Prevention, June 14, 2016.

4. “The right plant-based diet for you,” Harvard Health Publishing, January 2018,.

5. Umberson, Debra and Montez, Jennifer Karas, “Social Relationships and Health: A Flashpoint for Health Policy,” National Center for Biotechnology Information, August, 4, 2011.

6. Backes-Gellner, Uschi and Veen, Stephan, "The Impact of Aging and Age Diversity on Company Performance," University of Zurich, Accessed, April 11, 2018.

This insight was published by UFB Direct on April 9, 2019 and last updated on April 10, 2019.