article

Use the No-Spend Challenge to Save Money Quickly

Learn about our simple trick for kick-starting your savings goals.

As of December, 2023, the Federal Deposit Insurance Corporation insured over $4.5 billion in deposits. FDIC insured means that if a bank fails, the insured deposits are protected. A deposit made at a bank that is a member of the FDIC is insured up to $250,000. But is that the maximum possible coverage?

To determine how much insurance you have, you first need to discern if your account qualifies for coverage. If a bank is a member of the FDIC, any deposit account held at the bank is covered up to $250,000. This includes:

Checking

Saving

Money market

Certificate of Deposit

Cashier checks

Negotiable order of withdrawal

The FDIC does not cover investment or accounts such as:

Bond and stock investments

Mutual funds

Cryptocurrency

Annuities

Safe deposit boxes

A single person’s deposits can be insured up to $250,000, but there are ways to expand this coverage.

Each co-owner of a joint account is insured up to $250,000, and a joint account is insured up to $500,000. The $250,000 in the joint account is not counted toward a person’s single account deposit coverage. This means each co-owner can have another personal account insured up to $250,000.

Take Mary and John’s situation: Mary and John Smith are a married couple who open a joint account and a single account for each of them at an insured bank. Their joint account is insured up to $500,000, and their individual accounts are each insured up to $250,000.

Between the two of them, Mary and John have a total of $1 million in insured deposits.

Another way to boost your coverage is by adding beneficiaries to your accounts. Using the example with Mary and John, suppose they have two sons – Alan and Dale. They can put Alan and Dale as beneficiaries on their joint account, so it is now insured up to $1million.

But adding beneficiaries to joint accounts is not an infinite loophole. The FDIC caps insurance for a trust owner with five or more beneficiaries at $1.25 million.

For deposits more than $1.25 million, an insured cash sweep (ICS) account may be the best option. This type of account can provide insurance for millions of dollars. It works by spreading out your deposit in increments below the FDIC limit across a network of insured banks.

This type of account allows you to get millions of dollars in FDIC coverage and the convenience of a single bank relationship.

Interested in more coverage for UFB Direct accounts? Call 1-855-818-4113 or learn more about our InsureGuard + Savings option.

The FDIC provides a calculation tool, the Electronic Deposit Insurance Estimator calculator, to assist you in determining how much of your deposit is insured. You can use the EDIE calculator by entering your bank and account type and calculating how much of your deposit is covered.

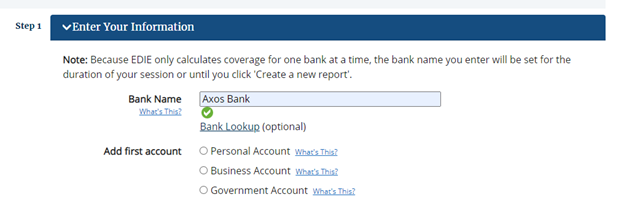

Enter your bank name and the type of account. Looking to see how much of your UFB Direct deposit is covered? UFB is an Axos Bank brand, so you should enter Axos Bank in the bank field of the calculator.

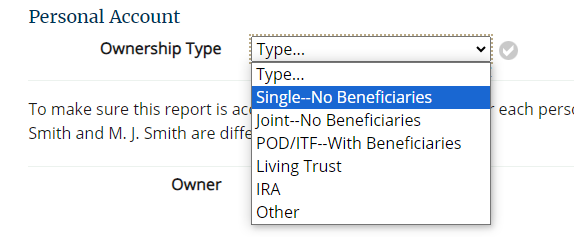

Select the Ownership Type from the dropdown menu. Choose from a single account with no beneficiaries, a joint account without beneficiaries, payable on death (POD)/ in trust for (ITF) account with a beneficiary, a living trust, or other.

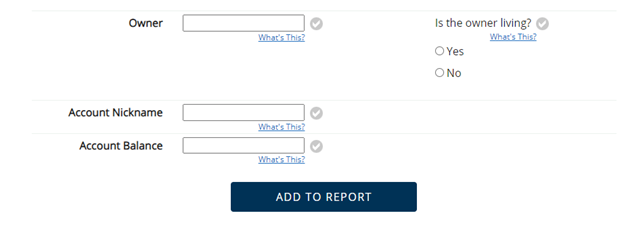

Enter the account owner, status, account nickname, and account balance. For this calculator, you do not need to use your official name; just use the exact same name to refer to the same person. The same rule applies to the account nickname. When you’ve finished, select Add to Report.

Repeat these steps for each account. When you’ve added all your accounts, choose Calculate Coverage to see how much of your deposit is insured.

When the calculation is run, you’ll receive a short summary of the information at the top of the report then the report details underneath.

FDIC EDIE is free, and there’s no limit to how many reports you can run, so take advantage of this great tool.

To determine if your bank is FDIC insured, look for the Member FDIC logo at the bottom of the bank web pages. You can also use the FDIC’s BankFind Suite tool to find out if your institution is part of the FDIC. UFB accounts are listed under Axos Bank certificate number 35546.

CDs or Certificate of Deposit accounts are deposit accounts and therefore insured up to $250,000 individual and $500,000 joint at institutions that are FDIC members.

There are many ways to extend your insurance. If you’re looking to substantially expand your coverage, the best option is to look at insured cash sweep accounts.

FDIC insurance covers deposits at member banks up to $250,000 single or $500,000 joint. If the insured institution fails, the FDIC typically pays out covered amounts within a few days.

The FDIC does not offer additional insurance for purchase. However, there are various insured cash sweep accounts which can expand your coverage.

Understanding deposit insurance coverage might seem complex, but it's crucial to know the extent of protection for your deposits. Here's what to do next:

Review current coverage: Carefully examine the amount of insurance on your accounts to understand how much of your deposits are safeguarded.

Assess needs for additional coverage: Based on your financial goals and the amount of your deposits, decide if your current coverage meets your needs or if you require additional protection.

A proactive approach ensures that you're not only informed about the security of your deposits but also equipped to take necessary steps for further financial safety.

This insight was published by UFB Direct on July 2, 2024 and last updated on July 2, 2024.